Schonhardt Corporation’s relevant range of activity is 4000, a crucial concept that underpins the company’s decision-making process. Understanding this range enables Schonhardt to optimize costs, pricing, and production levels, ultimately maximizing profitability.

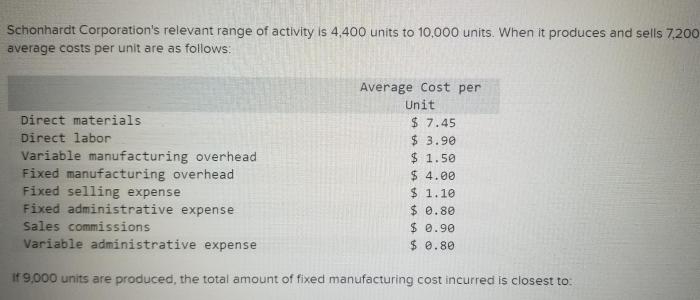

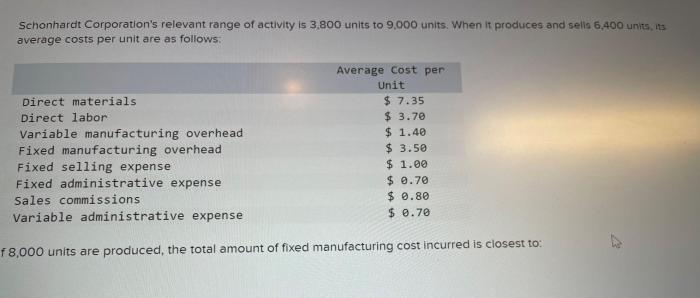

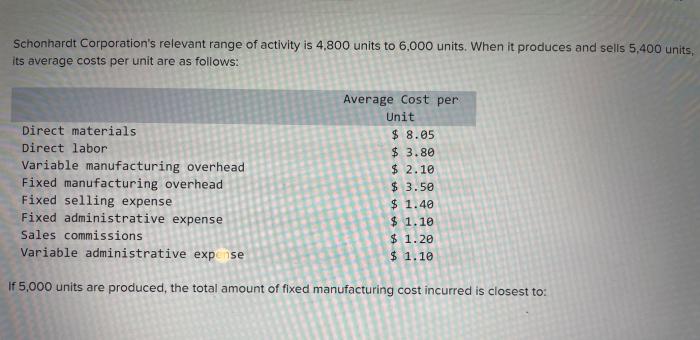

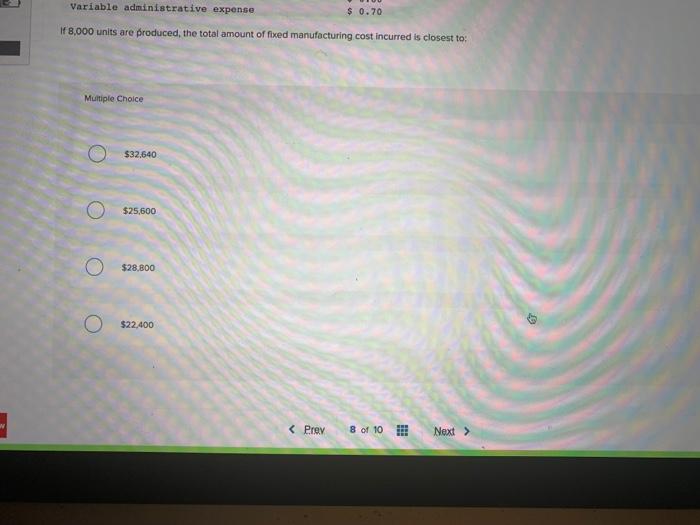

The relevant range of activity encompasses the output levels within which the company’s cost structure remains relatively stable. Factors influencing this range include production capacity, fixed costs, and market demand. By carefully considering both internal and external factors, Schonhardt can establish an accurate relevant range, ensuring informed decision-making.

Overview of Schonhardt Corporation’s Activities: Schonhardt Corporation’s Relevant Range Of Activity Is 4000

Schonhardt Corporation is a global manufacturer of industrial machinery and equipment. The company’s core business operations involve the design, production, and distribution of a wide range of products, including machine tools, automation systems, and robotics.

The concept of “relevant range of activity” is crucial for understanding Schonhardt Corporation’s operations. It refers to the range of production levels within which the company’s cost structure and operating characteristics remain relatively stable.

Establishing the Relevant Range of Activity

The relevant range of activity for Schonhardt Corporation is determined by a combination of internal and external factors.

Internal factorsinclude:

- Production capacity

- Fixed and variable costs

- Labor availability

External factorsinclude:

- Market demand

- Competition

- Economic conditions

The relevant range can vary depending on the industry and market conditions. For example, in industries with high fixed costs, the relevant range may be narrower than in industries with low fixed costs.

Impact of the Relevant Range on Decision-Making

The relevant range of activity has a significant impact on Schonhardt Corporation’s decision-making process.

When evaluating costs, pricing, and production levels, it is crucial to consider the relevant range.

For example, if the company is operating below the relevant range, it may experience higher unit costs due to underutilized capacity. Conversely, if the company is operating above the relevant range, it may face capacity constraints and increased production costs.

Case Study: Applying the Relevant Range to a Specific Situation

Consider the following scenario:

Schonhardt Corporation is considering expanding its production capacity by 20%. The company’s current relevant range is 4,000 units per year. The expansion would increase the company’s production capacity to 5,000 units per year.

Using the relevant range analysis, Schonhardt Corporation can evaluate the potential impact of the expansion on its costs, pricing, and profitability.

If the company’s market demand is expected to increase in the future, the expansion may be a sound investment. However, if market demand is expected to remain stable or decline, the expansion may not be justified.

Helpful Answers

What is the significance of the relevant range of activity for Schonhardt Corporation?

The relevant range of activity is crucial for Schonhardt as it provides a framework for evaluating costs, pricing, and production levels, enabling the company to optimize its decision-making and maximize profitability.

How does Schonhardt determine its relevant range of activity?

Schonhardt considers both internal factors (e.g., production capacity, fixed costs) and external factors (e.g., market demand) to establish its relevant range of activity, ensuring an accurate representation of its operating environment.

What are the potential consequences of not considering the relevant range of activity when making decisions?

Ignoring the relevant range of activity can lead to suboptimal decisions regarding costs, pricing, and production levels, potentially resulting in reduced profitability and competitive disadvantage.