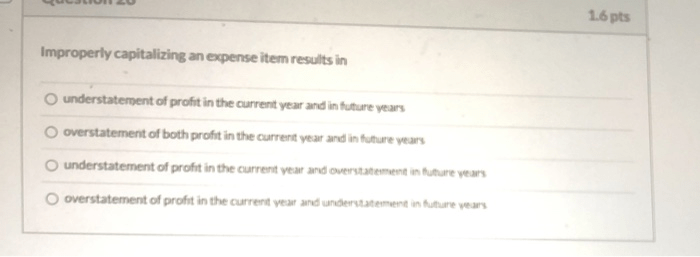

Improperly capitalizing an expense item results in – Improperly capitalizing expense items can have significant consequences for financial reporting, compliance, and the overall accuracy of financial statements. This comprehensive analysis delves into the complexities of expense capitalization, exploring its impact on financial reporting, the relevant accounting standards and regulations, methods for correcting errors, and best practices for ensuring accurate and reliable financial reporting.

Improperly Capitalizing Expense Items

Improperly capitalizing an expense item can have significant consequences for financial reporting, compliance, and the overall accuracy of financial statements. It can lead to overstatement or understatement of assets and expenses, which can mislead investors, creditors, and other stakeholders.

Impact on Financial Reporting

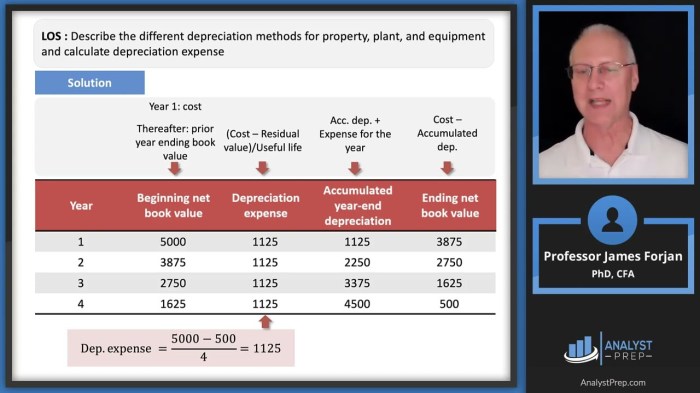

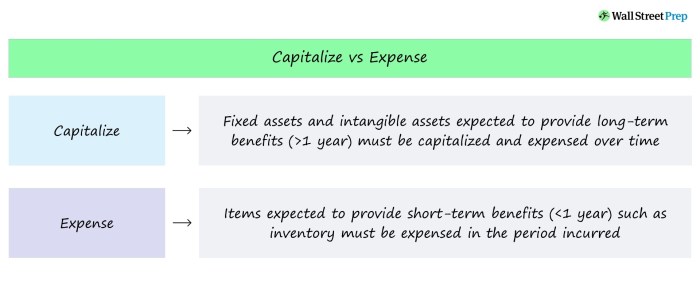

When an expense item is improperly capitalized, it is recorded as an asset on the balance sheet instead of being expensed in the income statement. This can lead to an overstatement of assets and an understatement of expenses, which can distort the company’s financial performance and make it appear more profitable than it actually is.

Compliance Issues, Improperly capitalizing an expense item results in

The capitalization of expenses is governed by accounting standards and regulations, such as the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). Non-compliance with these standards can result in penalties, legal liabilities, and damage to the company’s reputation.

Methods of Correcting Errors

If an error in expense capitalization is discovered, it can be corrected through journal entries or restatements. Journal entries are used to adjust the accounts affected by the error, while restatements involve revising the financial statements to reflect the correct information.

Best Practices for Expense Capitalization

To avoid errors in expense capitalization, it is important to establish clear guidelines and procedures for determining which expenses should be capitalized. This should include a consideration of the nature of the expense, its expected useful life, and its potential impact on the company’s financial statements.

Case Studies and Examples

Several real-world examples of improper expense capitalization have been documented. In one case, a company capitalized research and development costs as an asset, which resulted in an overstatement of assets and an understatement of expenses. This led to an inflated stock price and ultimately a loss of investor confidence.

FAQ Resource: Improperly Capitalizing An Expense Item Results In

What are the potential consequences of improperly capitalizing expense items?

Improperly capitalizing expense items can lead to overstatement or understatement of assets and expenses, resulting in inaccurate financial statements and potentially misleading financial reporting.

What accounting standards govern the capitalization of expenses?

The capitalization of expenses is governed by accounting standards such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP).

How can errors in expense capitalization be corrected?

Errors in expense capitalization can be corrected through journal entries or restatements, depending on the materiality and timing of the error.